Quick Money Solutions - Your Instacash Funds Guide

Unexpected bills, a sudden car repair, or just needing a little extra to get through to your next payday can feel like a heavy burden, can't it? That feeling of being a bit short on cash, is that, when you really need it, is something many of us have experienced. It's in these moments that finding a simple, straightforward way to access some immediate money can make a real difference in how you feel, and, you know, help you manage things.

This is where something like Instacash funds comes into the picture, offering a way to tap into a portion of your own earned money, giving you a bit of breathing room. It's about providing a helpful hand when your personal finances feel a little stretched, without adding more stress to your plate. It's, like, a pretty direct approach to a common problem, honestly.

So, if you're wondering about how to get your hands on some quick money without all the usual fuss and bother, this article will walk you through what Instacash funds are all about. We'll talk about how they work, what they can do for you, and how you can get started, basically making it very clear and simple.

- Roblox Creator Dashboard

- Teach Me First Honey Toons

- Klonoaphantasy Erome

- Teach Me First Honeytoon Free

- Is Crystal Mckellar Married

Table of Contents

- How Do You Get Instacash Funds?

- What Makes Instacash Funds Different?

- How Can Instacash Funds Help You?

- What Are The Limits With Instacash Funds?

How Do You Get Instacash Funds?

Getting your hands on Instacash funds is, in a way, pretty straightforward, honestly. The first step is usually to open up the application on your phone, the one where you manage your money. Once you're in there, you'll want to find a specific button or section, often labeled something like "Instacash" right on the main screen, which, you know, makes it easy to spot. Tapping on that particular button is your entry point to seeing if you can get some of those Instacash funds.

After that, the process is rather simple, really. The main thing you need to do is make sure your regular checking account is connected to the app. This connection is how the service can verify things and, ultimately, how the money gets to you. It's not like a complicated setup; it's more about making sure the right accounts are talking to each other, which, basically, just takes a moment or two. Once that link is established, you're pretty much set to put in your request for Instacash funds, which is, you know, a very easy step.

What Makes Instacash Funds Different?

So, what sets Instacash funds apart from other ways you might get a bit of money when you're in a pinch? Well, it's about a few key things that make it a pretty appealing option for many people. One of the biggest differences is how it handles the cost of getting that money. Unlike some traditional methods where you might find yourself paying extra just to access your own earnings a little early, this service tries to keep things much simpler, which, honestly, is a welcome change for a lot of us.

- John Travolta Dead By Daylight

- Openai Chatgpt Plus Iran Payment Options

- Grace Sward

- How To Purchase Chatgpt Plus From Iran

- Is Christopher Reeve Related To George Reeves

Another important aspect is how it's classified. It's not set up like a typical borrowing arrangement, which means it doesn't come with some of the more stressful parts that can sometimes go along with taking out money. This distinction is, in some respects, quite significant because it changes the whole experience of getting financial help. It's designed to be a supportive tool, rather than something that adds to your worries, which is, you know, a big relief for many people looking for Instacash funds.

No Extra Costs for Instacash Funds

One of the truly appealing things about Instacash funds is what it doesn't ask of you. When you get a portion of your upcoming earnings through this service, you won't find yourself paying any extra for the privilege. There's no interest that builds up over time, which means the amount you receive is the amount you'll be expected to sort out later, nothing more. This absence of an added cost for borrowing your own money is, you know, a pretty big deal for people who are trying to manage their budget carefully.

Beyond that, there are typically no required charges that you have to pay. This means you don't have to worry about unexpected costs popping up that might make the amount you're getting less helpful. It's a very transparent way to get access to money, which, basically, helps you feel more in control. This straightforward approach, where what you see is what you get, really helps in making Instacash funds a stress-free option for when you need a bit of financial support, and, you know, that's pretty good.

A Helping Hand, Not a Heavy Debt

It's really important to understand that Instacash funds are set up as a way to get an early part of your income, not as a standard loan. This difference is, in a way, quite meaningful for your peace of mind. Because it's considered an advance on your own money, you won't have the worry of debt collectors getting in touch with you. It's not like a traditional borrowing situation where you're taking on new financial obligations that could lead to uncomfortable follow-ups, which, you know, is a huge relief for many people.

Furthermore, because it's not viewed as a loan, using Instacash funds typically doesn't get reported to the organizations that keep track of your borrowing history. This means that taking advantage of this service won't usually have an impact on your credit standing, either positively or negatively. For people who are trying to keep their financial record clear, or who might not have a long credit history, this particular feature is, honestly, a very valuable aspect. It allows you to get the money you need without adding any potential complications to your future financial arrangements, which, basically, is a pretty good deal.

How Can Instacash Funds Help You?

So, beyond just getting quick money, how else might Instacash funds be helpful in your daily life? Well, it turns out that having that bit of extra cash can open up some interesting possibilities for managing your finances more broadly. For instance, having access to these funds could mean you're in a better position to look at other financial products, like different kinds of payment cards that offer benefits. The very service that offers Instacash funds also helps you look at payment cards that come with features such as getting money back on what you spend, or cards that have lower interest rates, or even those that offer ways to pay back what you owe on a schedule that suits you, which, you know, is pretty neat.

This means that by getting your immediate needs met with Instacash funds, you might find yourself with more flexibility to make smart choices about your money. It's about empowering you to consider options that could save you money or give you more financial freedom in the long run. When you're not stressed about immediate cash flow, you can, in some respects, think more clearly about your overall financial picture. It's a bit like having a clear head to make good choices, basically, which is always a plus.

Also, when something urgent pops up, and you need money right away, the application that provides these Instacash funds is set up to be a quick solution. It's there for those moments when you can't wait for your next regular payment to come through. Whether it's an unexpected bill that just landed, or something you simply must take care of immediately, having a way to get some cash quickly through your phone can be a true lifesaver. It’s, you know, pretty much designed for those times when every moment counts, which, honestly, is very reassuring.

What Are The Limits With Instacash Funds?

When you're thinking about using a service like Instacash funds, it's natural to wonder about the practical details, like how much money you can actually get and how quickly it arrives. The service aims to offer a good amount of ease and speed, which, you know, is pretty important when you're in need of money. Generally, you can get advances up to a certain amount, typically around $500, which for many everyday unexpected costs, is often enough to cover things. This limit is set to help you with common financial bumps without encouraging you to take on too much, basically.

However, it's worth noting that for some people who meet particular requirements, the amount you can get might be a bit higher, sometimes even up to $1,000. This higher limit is usually for those who have a stronger connection to the service or meet certain specific criteria that show they're in a good position to manage a larger advance. So, while there's a common ceiling, there's also a chance to access a bit more if your financial situation aligns with what the service looks for, which, you know, is a pretty flexible approach.

Quick Access to Instacash Funds

One of the most valuable aspects of Instacash funds, especially when you have an urgent need, is how quickly the money can show up in your account. While some advances might take a few business days to process and arrive, which is still faster than many traditional methods, there's also the possibility of getting your money almost instantly. Imagine, you know, needing cash right now for something important, and having it land in your bank account within minutes of making your request. That kind of speed can really make a difference when time is of the essence, which, basically, is very convenient.

This rapid deposit means you don't have to sit around waiting and worrying. It's about providing a truly immediate solution for those times when you simply can't afford to wait. The convenience of getting money deposited so quickly is a major reason why many people find Instacash funds to be such a useful tool for managing those unexpected financial situations that pop up in life, and, you know, it's pretty comforting to have that option.

Getting Started with Instacash Funds

If you're thinking about getting started with Instacash funds, the process is usually made to be as simple as possible. Often, there's a quick way to begin just by using your phone's camera. You might see a special image or code that you can point your camera at, and it will guide you through the initial steps. This makes the whole setup feel very modern and easy, without a lot of complicated forms to fill out right away, which, honestly, is a pretty smooth way to get going.

Once you've done that, you'll simply follow the straightforward instructions that appear on your screen. These steps are designed to be clear and easy to understand, making sure you can quickly get to the point where you can request your cash. The whole idea is to make getting money when you need it less of a chore and more of a simple, quick action. It's about getting cash whenever you want it, for whatever you want to use it for, without a lot of fuss, which, you know, is very freeing.

So, whether you're looking to cover a small unexpected cost, or just need a little boost until your next payment comes in, Instacash funds offer a pretty direct and easy way to get some financial support. It's about providing access to your own money, without the usual complications of borrowing, and doing it quickly. This service aims to give you a bit of breathing room when you need it most, making financial bumps a little less bumpy.

- Barbara Bach Sister

- Chatgpt Plus Subscription Purchase Iran

- Chatgpt Subscription Price Iran

- Connie Francis Current Health Status

- Real Carly Jane Real Name

InstaCash | Goshen NY

Instacash

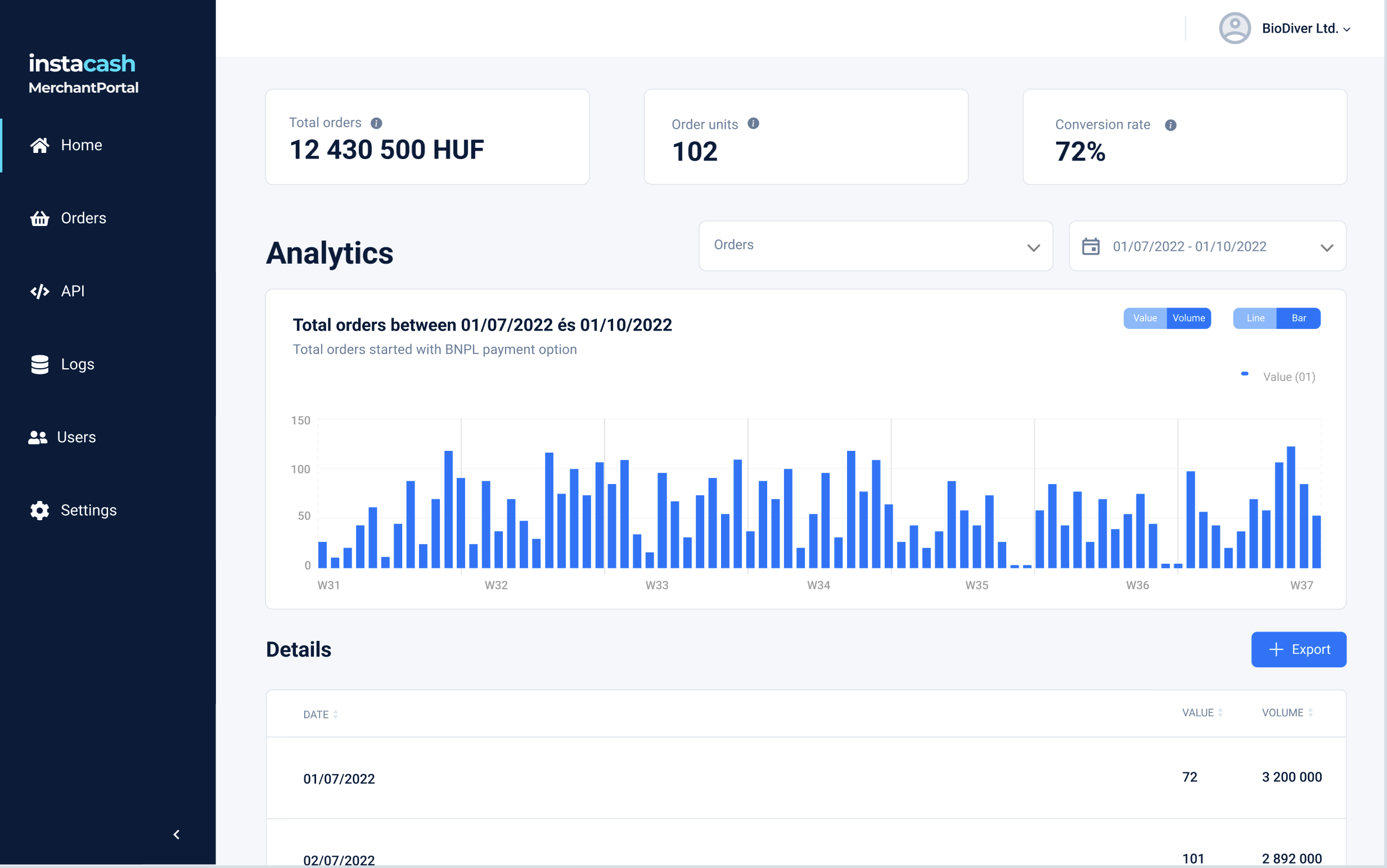

InstaCash – White-label BNPL solutions