Instacash Keywords - Your Quick Cash Solution

Sometimes, life just throws unexpected things your way, doesn't it? Maybe a small bill pops up out of nowhere, or perhaps you just need a little something extra to get by until your next paycheck arrives. It's a pretty common feeling, that sudden need for a bit of extra money, and it can feel a little stressful, too. Finding a way to bridge that gap, without getting tangled up in complicated financial arrangements, is what many people are looking for, you know?

For a lot of folks, the idea of getting a quick cash advance might bring up thoughts of loans with high interest rates or a lot of paperwork. That's a natural concern, actually, because traditional borrowing can often feel like a big hurdle. But what if there was a way to get some funds that felt more like accessing your own money, just a little sooner than planned? It's about finding a simpler path, really, to handle those immediate financial needs.

This article will explain how a service like Instacash works, breaking down what it offers and how it can be a helpful tool for managing those small, urgent money situations. We'll look at how you can get started, what makes it stand out, and why it's different from a typical loan. So, if you're curious about getting quick access to a bit of your earned money, without a lot of fuss, keep reading.

- Is Christopher Reeves Related To George Reeves

- Erome Laraa Rose

- Hattel

- Roblox Dashboard

- Lara Rose Nudes Erome

Table of Contents

- What is Instacash and How Does It Work?

- How Can Instacash Help You?

- What Makes Instacash Different?

- Are There Any Requirements for Instacash?

- What About MoneyLion and Instacash?

- How Fast Can You Get Instacash?

- What Can You Use Instacash For?

- Comparing Instacash with Other Options

What is Instacash and How Does It Work?

So, you might be wondering, what exactly is Instacash, and how does it actually function? Well, it's pretty straightforward, really. Think of it as a way to get a portion of the money you've already earned from your job, but before your regular payday. It's like getting a small advance on your salary, which can be super helpful when you need cash right away. This kind of service is designed to give you a bit of breathing room financially, especially when unexpected expenses pop up or you just need to cover something before your next deposit comes in. It's a pretty neat concept, you know, because it's built around your own earnings.

The main idea behind Instacash is to give people a simple way to get some funds without the usual hassle that comes with borrowing money. It's not a loan in the traditional sense, and that's a key point. Instead, it's more like an early access to your own pay. This means you won't have to worry about things like interest charges piling up or dealing with debt collectors later on, which is a big relief for many. It's a very different approach to getting a bit of extra money when you need it most, focusing on what you've already earned.

Getting Started with Instacash Keywords

To get going with Instacash, it's actually pretty simple. All you really need to do is link your checking account. That's the main step to applying, you see. Once your account is connected, the service can look at your regular income and figure out how much of an advance you might qualify for. This process is usually quick and designed to be user-friendly, so you don't have to jump through a lot of hoops. It's about making the process of getting a little financial help as easy as possible, so you can focus on what you need the money for. This simple start is a big part of what makes Instacash keywords appealing to many.

- Grace Sward Porn

- Kimbella Vanderhee

- Chatgpt Plus Access Iran

- Chatgpt Plus Availability Iran Openai

- Celeste Ackelson

How Can Instacash Help You?

You might be asking yourself, how exactly can something like Instacash genuinely help someone out? Well, think about those times when you're just a little short on funds, perhaps for a bill that's due before your next payday, or maybe an unexpected repair. This service is set up to give you access to money right when you need it most, which can really make a difference in a tight spot. It's about providing a safety net, in a way, for those small, immediate financial needs that pop up in everyday life. The quick access means you can handle things without waiting or feeling stuck.

One of the really good things about Instacash is that it offers a way to get funds for pretty much anything you want. Whether it's for groceries, a sudden medical bill, or just to cover a gap until your next pay comes in, the money is there for your use. This flexibility is something people really appreciate, because it means the service adapts to your life, rather than the other way around. It’s about giving you control over your immediate financial situation, you know, without a lot of strings attached. This kind of freedom with your money is a big plus for many users.

The Benefit of Instacash Keywords - No Interest

A very important part of what Instacash offers is that it comes with absolutely no interest. This is a huge benefit, really, because it means you're not paying extra for the money you get. Unlike many traditional loans where interest can add up quickly, with Instacash, the amount you get is the amount you pay back. There are no mandatory fees either, which is a big relief for your wallet. This straightforward approach to costs is what makes Instacash keywords a very appealing option for those looking for a temporary financial boost without hidden charges or growing debt. It's pretty transparent, which is nice.

What Makes Instacash Different?

So, what sets Instacash apart from other ways of getting a bit of extra money? A key difference is how it handles credit. Many financial services will check your credit history before they agree to give you money, and if your credit isn't perfect, that can be a real barrier. With Instacash, they don't do a credit check. This means that your past financial history, or lack thereof, won't stop you from getting the funds you need. It's a pretty inclusive approach, really, making it accessible to a wider range of people who might otherwise struggle to get help. This lack of a credit check is a significant feature, you see, that truly distinguishes it.

Another important aspect that makes Instacash stand out is its nature as a cash advance rather than a loan. This distinction is more than just words; it has practical implications. Because it's not considered a loan, you don't have to worry about debt collectors getting involved, which can be a source of a lot of stress for people. Also, it doesn't get reported to credit bureaus, meaning it won't impact your credit score, either positively or negatively. This makes it a much less stressful option for those short-term money needs, offering peace of mind that you're not affecting your long-term financial standing. It's a very different kind of financial tool, in some respects.

Understanding Instacash Keywords - Not a Loan

It's pretty important to grasp that Instacash is truly a cash advance, and not a loan. This means the money you get is a portion of your upcoming earnings, not a new debt you're taking on. This is a big deal because it changes the whole dynamic of how you think about and use the money. You're essentially getting paid a little earlier, which is quite different from borrowing money that then needs to be repaid with interest and often comes with a formal repayment schedule. This distinction is at the core of what makes Instacash keywords a helpful tool for many, offering a straightforward way to manage cash flow without the usual loan burdens.

Are There Any Requirements for Instacash?

You might be wondering if there are specific things you need to have in place to qualify for Instacash. It's a fair question, as most financial services do have some kind of criteria. The main thing you need to do is link your checking account. That's how the service connects to your income and can determine how much of an advance you might be able to get. They look at your regular deposits to understand your earning pattern, which helps them decide on the advance amount. It's a pretty simple process, really, designed to be as easy as possible for you to get the help you need without a lot of hurdles. So, having a checking account that receives regular deposits is key, you know.

Beyond linking your account, the process is pretty streamlined. As mentioned, there's no credit check involved, which removes a common barrier for many people. This means that even if your credit history isn't perfect, or if you don't have much of one at all, you can still be considered for an Instacash advance. The focus is more on your ability to receive regular income through your linked checking account. This makes it a widely accessible option for a lot of individuals who might find it hard to get help elsewhere. It's very much about your current financial flow, rather than your past credit behavior.

Qualifying for Instacash Keywords

To qualify for Instacash keywords, the main step is to simply link your checking account to the service. This allows the system to see your regular income and determine the amount of money you might be able to get as an advance. It's a pretty straightforward process, and it focuses on your consistent earnings rather than your credit score. This approach means that a lot of people can qualify, making it a widely available option for those needing a quick financial boost. The simplicity of the qualification process is a big part of its appeal, honestly, making it less intimidating than other financial avenues.

What About MoneyLion and Instacash?

When you hear about Instacash, you'll often hear it mentioned alongside MoneyLion. That's because MoneyLion is the app and the company that provides this particular cash advance service. It's basically a feature within the broader MoneyLion financial platform. So, if you're looking to access Instacash, you'll typically do so through the MoneyLion app. This integration means that Instacash is part of a larger set of financial tools that MoneyLion offers, though the cash advance is a very popular part of what they do. It's a pretty convenient way to get things done, you know, having it all in one place.

MoneyLion's Instacash feature is designed with convenience in mind, offering cash advances that can go up to $500 for most users. For those who have a qualifying RoarMoney account, the advance amount can even go up to $1,000. This tiered system means that loyal users or those who engage more with MoneyLion's other services might get access to a larger sum. It's a way for the service to grow with your financial needs, in a way. The fact that it's all handled through an app makes it very accessible and easy to manage, which is a big plus for busy people.

Instacash Keywords Through MoneyLion

Instacash keywords are most commonly associated with the MoneyLion app, which is the platform that delivers this cash advance service. It's pretty much the go-to place for getting these advances. Through the app, users can get funds, typically up to $500, but some can even get up to $1,000 if they have a specific type of MoneyLion account called RoarMoney. This connection means that the ease of using the Instacash service is tied directly to the MoneyLion experience, making it simple to access and manage your financial needs from your phone. It’s a pretty integrated system, you see.

How Fast Can You Get Instacash?

When you need money, you often need it quickly, right? That's where Instacash really tries to deliver. The goal is to get the funds into your account as fast as possible. In many cases, the money can be deposited into your account within minutes of your request being approved. This speed is a huge advantage for urgent needs, like covering an unexpected bill or making a purchase that just can't wait. It's not like waiting days for a bank transfer; it's almost immediate access, which is pretty helpful in a pinch. This rapid delivery is a core part of the service's appeal.

While some advances can arrive almost instantly, MoneyLion's Instacash feature generally aims for a maximum of five business days or less for the funds to arrive. This still beats many traditional financial processes, but it's good to know that "minutes" is often an option, especially if you're in a hurry. The speed of access is a very important consideration for anyone looking for a cash advance, and Instacash really tries to make that process as quick as it can be. It’s about getting you the money when you need it, not days later. So, you can usually count on it being pretty fast.

Quick Access with Instacash Keywords

One of the most appealing aspects of Instacash keywords is how quickly you can get the money. Once your request is approved, the funds can often be deposited directly into your account within minutes. This rapid access is incredibly useful for those times when you have an urgent need for cash and can't afford to wait. While some advances might take a few business days, the option for near-instant deposit is a major convenience, making it a truly immediate solution for your financial needs. It’s pretty impressive how fast it can be, actually.

What Can You Use Instacash For?

The beauty of Instacash is its flexibility when it comes to what you can use the money for. Unlike some specific loans that might be tied to a particular purpose, Instacash gives you cash that you can use for anything you want. This means if you need to cover a utility bill, buy groceries, pay for a small car repair, or just manage day-to-day expenses until your next paycheck, the money is there for your discretion. There aren't any restrictions on how you spend it, which gives you a lot of freedom. It’s really about empowering you to handle whatever life throws your way, you know, without judgment.

This "cash anytime for anything you want" approach is a significant benefit for people facing various financial situations. It's not about what the service thinks you should spend money on; it's about giving you the means to address your own immediate needs. This versatility makes Instacash a practical tool for a wide range of short-term financial gaps. Whether it's an unexpected expense or just a little extra to get through the week, the funds are available for your personal use. It’s pretty much a general-purpose financial helper, in a way.

Flexible Uses for Instacash Keywords

The money you get through Instacash keywords can be used for just about anything you need. There are no specific rules or categories for how you spend it, which is a big plus for many people. Whether it's to cover a small emergency, pay a bill that's due, or simply manage daily expenses until your next payday, the funds are yours to use as you see fit. This flexibility makes Instacash a very adaptable solution for various immediate financial situations, giving you the freedom to address your specific needs without restriction. It's very much about meeting your personal requirements.

Comparing Instacash with Other Options

When you're thinking about getting a bit of extra money, you probably compare different choices, right? Instacash stands out from many traditional options because it's designed to be a straightforward cash advance, not a typical loan. This means it doesn't come with the usual interest charges that can make borrowing money feel expensive. Also, the fact that there's no credit check means it's accessible to a broader group of people who might not qualify for other types of financial assistance. It's a pretty different kind of offering, in some respects, focused on quick, simple access to a portion of your own earnings.

Many people find Instacash appealing because it avoids the complexities often associated with traditional lending. There are no mandatory fees to worry about, and it won't impact your credit score, which is a big relief for those concerned about their financial standing. This clear and simple structure makes it a less intimidating option for managing short-term cash needs. It's about providing a quick solution without adding long-term financial burdens or stress. It really tries to be a helpful tool for those immediate gaps, you know, without the usual fuss.

Instacash Keywords and Your Financial Picture

Considering Instacash keywords in your overall financial planning means looking at a solution that offers quick, interest-free access to funds without a credit check. This can be a very helpful part of your financial picture, especially for managing unexpected costs or bridging gaps between paychecks. It stands apart from traditional loans because it doesn't add to your debt burden in the same way, nor does it impact your credit score. It's more about getting a piece of your earned money a little early, which can provide a sense of stability and control over your immediate finances. It's pretty much a simple way to get some quick cash, you see.

- Fwtina Leaks

- Chatgpt Plus Subscription Purchase Iran

- Openai Chatgpt Plus Payment Iran

- How To Subscribe To Chatgpt Plus In Iran

- How To Pay For Chatgpt Plus From Iran

Instacash

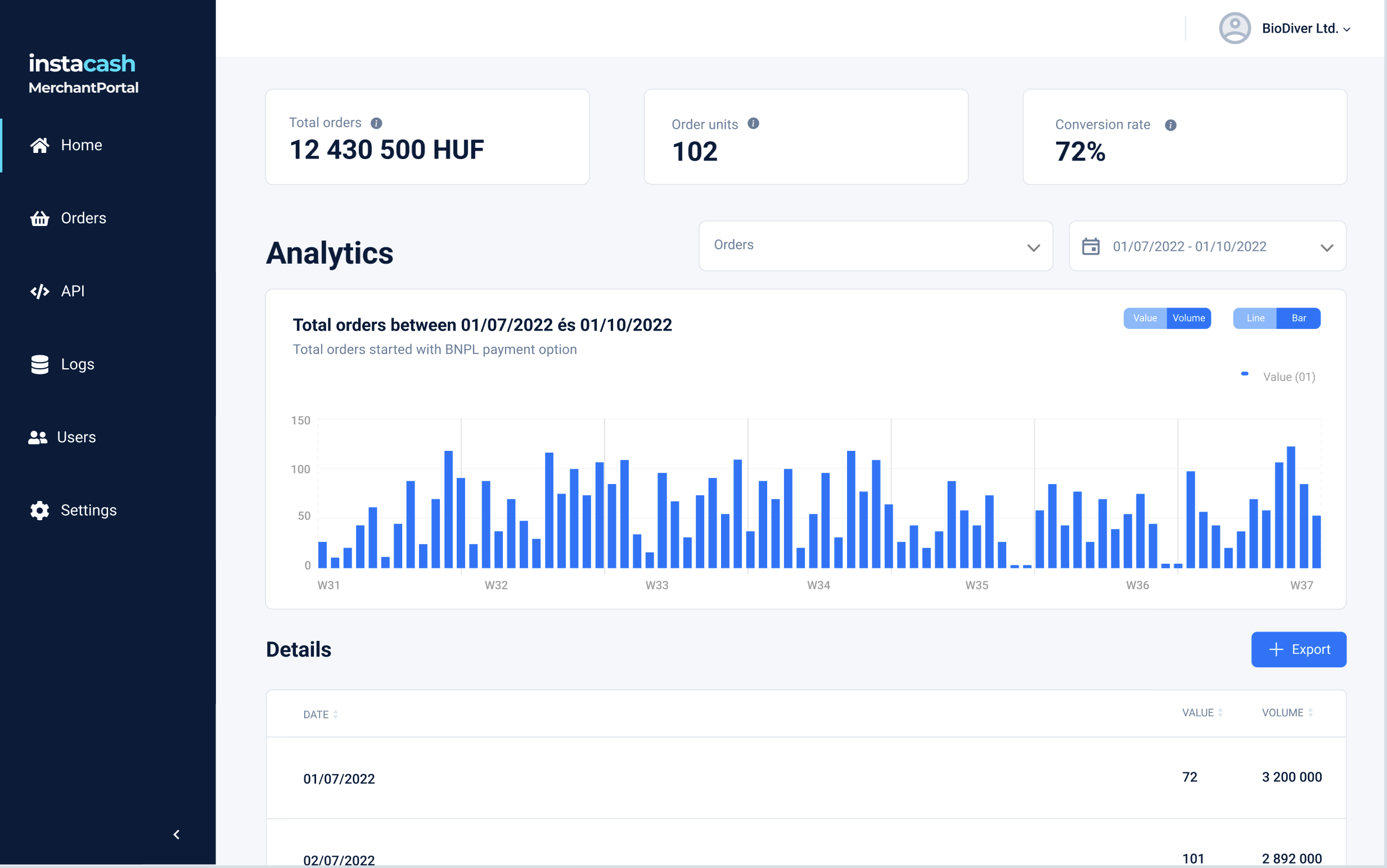

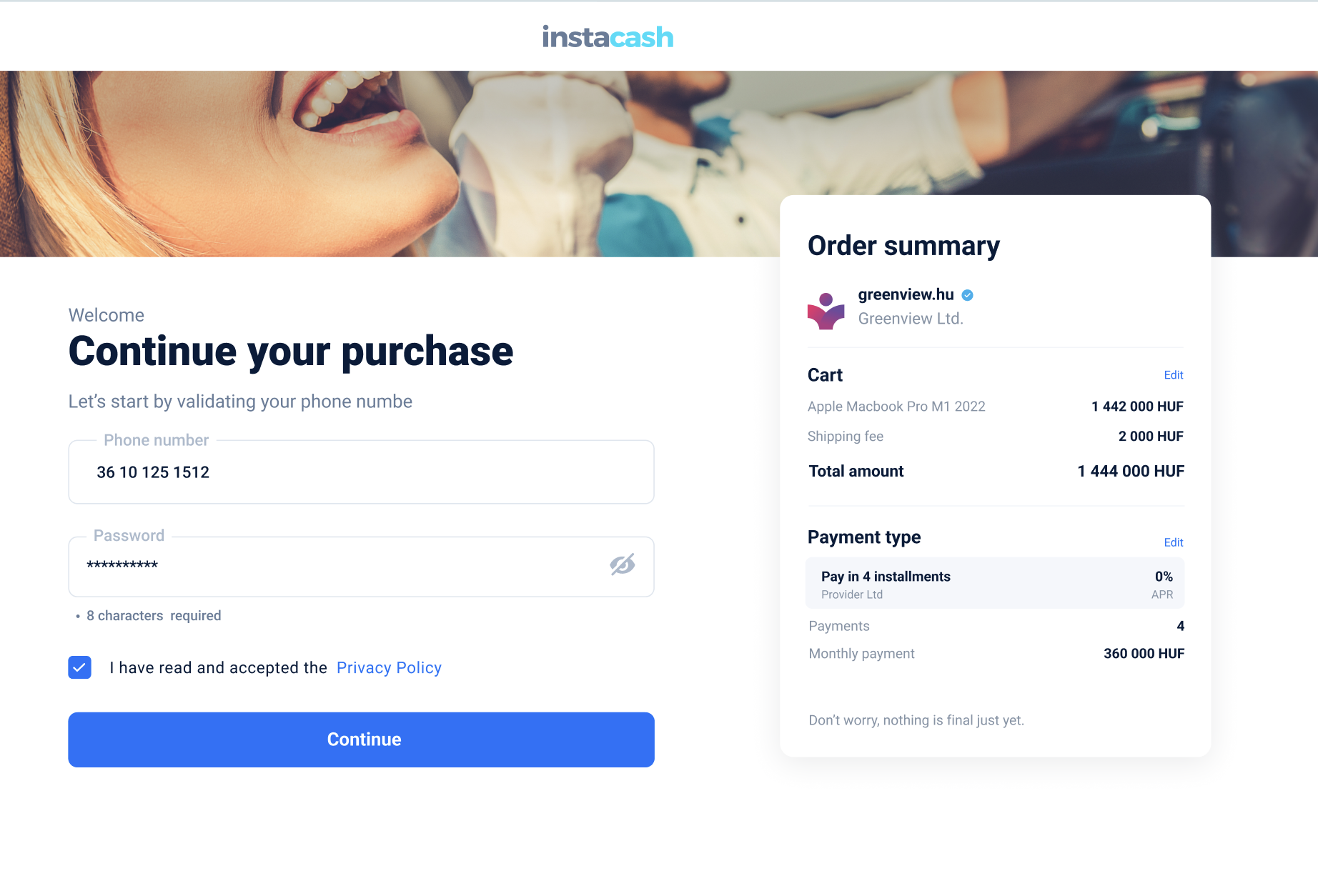

InstaCash – White-label BNPL solutions

InstaCash – White-label BNPL solutions